Asset Offering

Kickstart your asset offering with countless options and configurations like offering restrictions and limits, different offering phases and market data interations.

Offering Definition

Quickly Create

Offerings

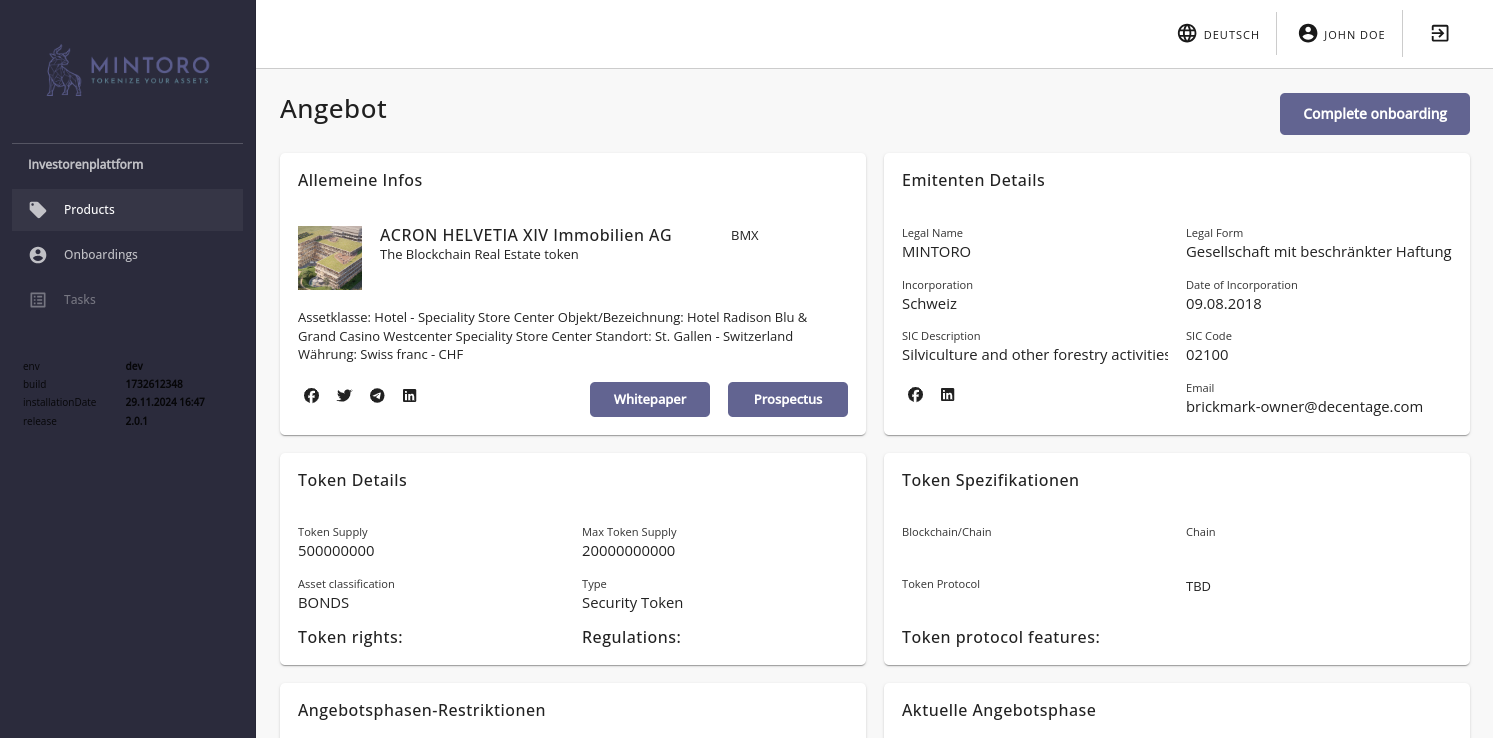

After a token is approved, issuers can initiate the offering process by defining its start and end dates, establishing a clear timeline for investors. The process includes configuring key parameters such as token pricing, allocation limits, and eligibility criteria for participants.

This structured approach ensures compliance with regulatory standards and provides a solid framework for successful token sales.

Offering Restrictions & Limits

Design your Offering

Issuers can configure specific investor types, such as retail, institutional, or accredited investors, to participate in the offering. For each enabled investor type, detailed requirements can be configured, including terms and

conditions, compliance forms, and

identification methods.

Furthermore, issuers can establish restrictions by defining blacklists for certain domiciles or nationalities, ensuring compliance with legal and regulatory frameworks.

Dashboard

Monitor your Offering

The Dashboard provides issuers with an intuitive interface to monitor key metrics that are crucial for tracking the progress of token offerings. These metrics include investor participation, token sales, payment statuses, and overall offering performance. With real-time data visualization, issuers can quickly identify trends and make informed decisions to optimize their offerings effectively.

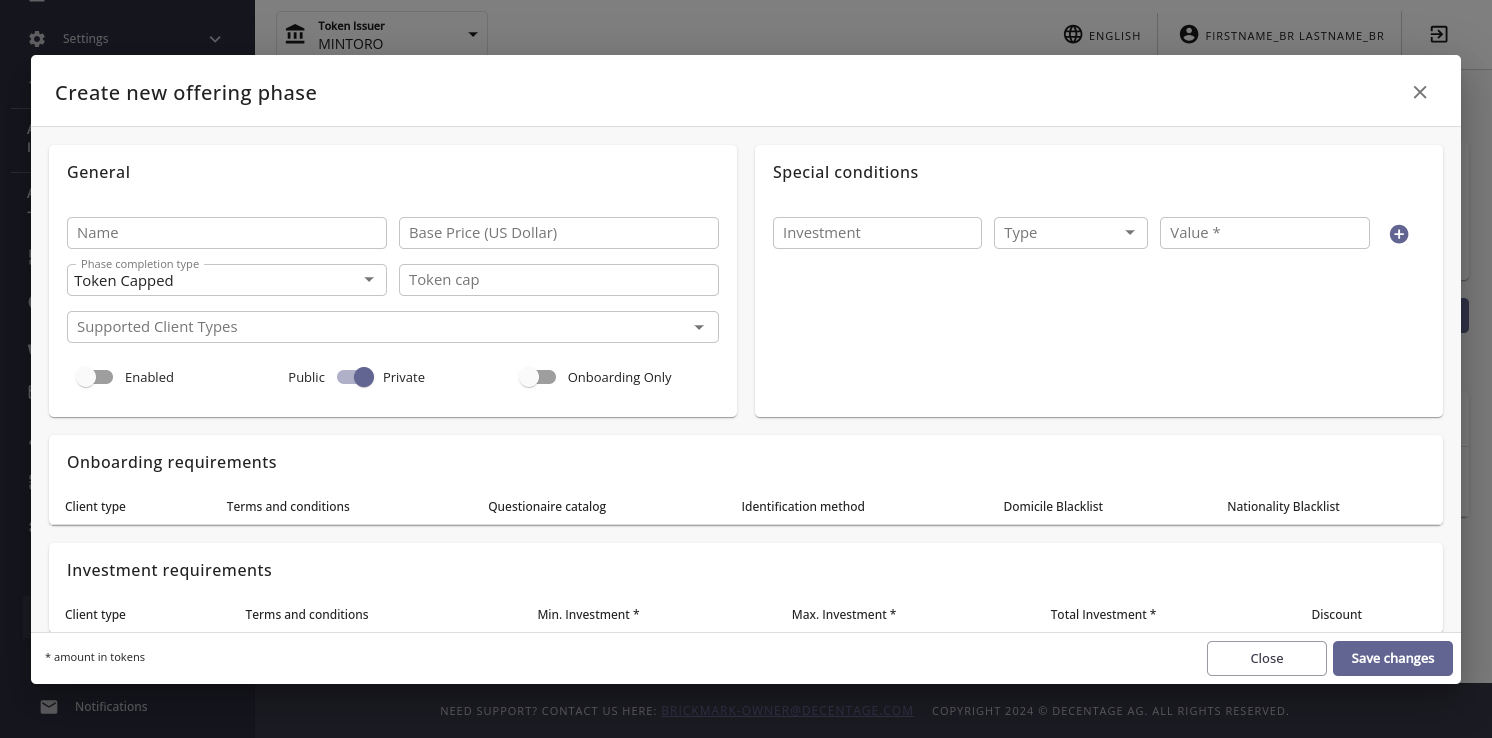

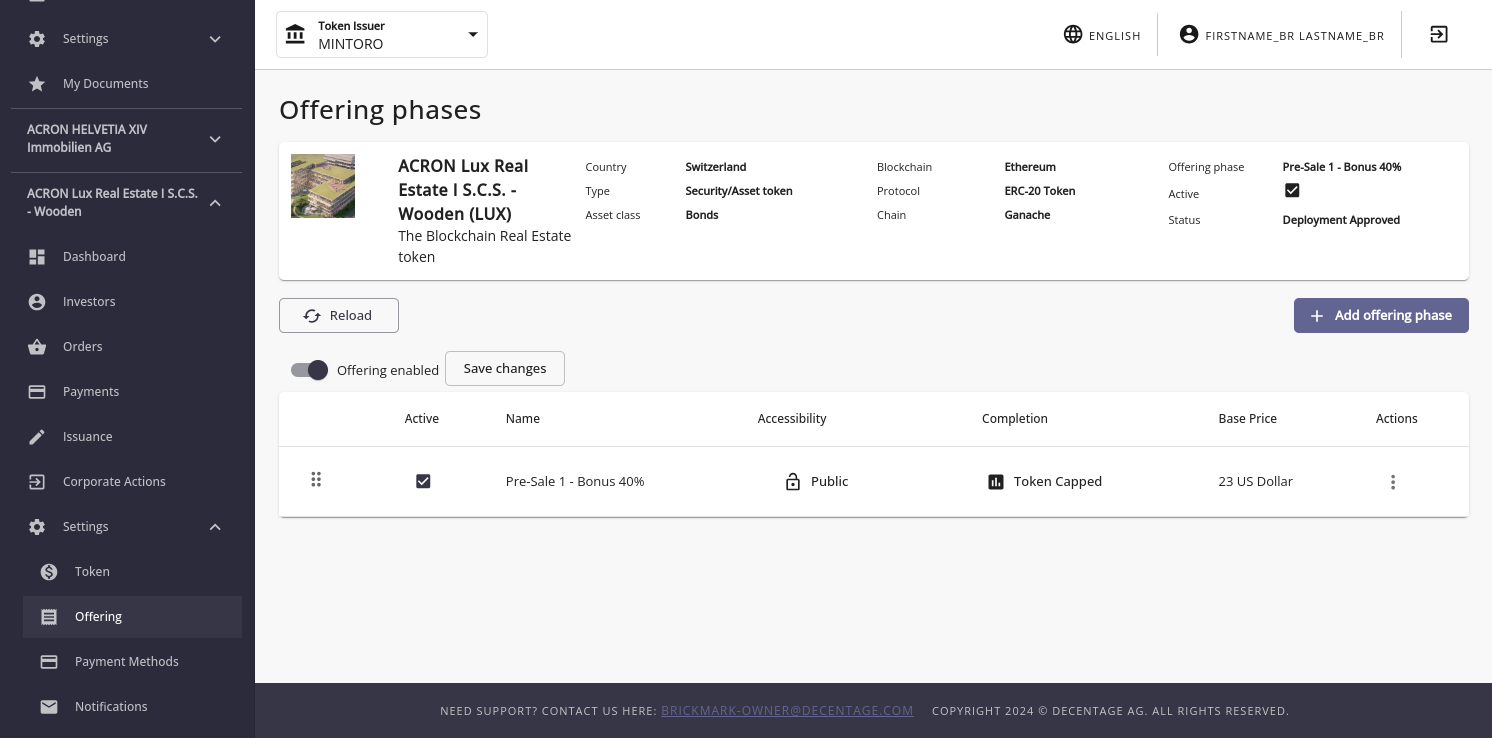

Offering Phases

Tailored to your Needs

The offering phase feature allows issuers to configure key aspects of their token offering to meet specific business and regulatory requirements. Issuers can define the base price of the token and set a maximum token cap to control the supply available for the offering phase. Special conditions, such as bonuses for early investors, can also be specified to incentivize participation.

Market Data

Real-time

Market Integration

MINTORO utilizes real-time exchange rates to provide accurate and up-to-date market data. This ensures that investors and issuers have access to precise valuation metrics, enabling better decision-making during token transactions and offerings. The integration of real-time data enhances transparency and trust across the platform.

Key benefits

Every feature you need,

all in a single system

Our SaaS solution is designed to bring the power of blockchain technology to the realm of asset management.

-

State of the art enterprise architecture

-

Flexible, Customizable and Secure

-

Efficient processes and workflows

User Portals

Service Providers

Supported Blockchains

Modules

Learn more

Ready to digitalize your business?

Whether you are an asset owner looking to unlock liquidity or an investor seeking new opportunities, our platform is your gateway to the future of digital assets.